Historical Context and Current Trends

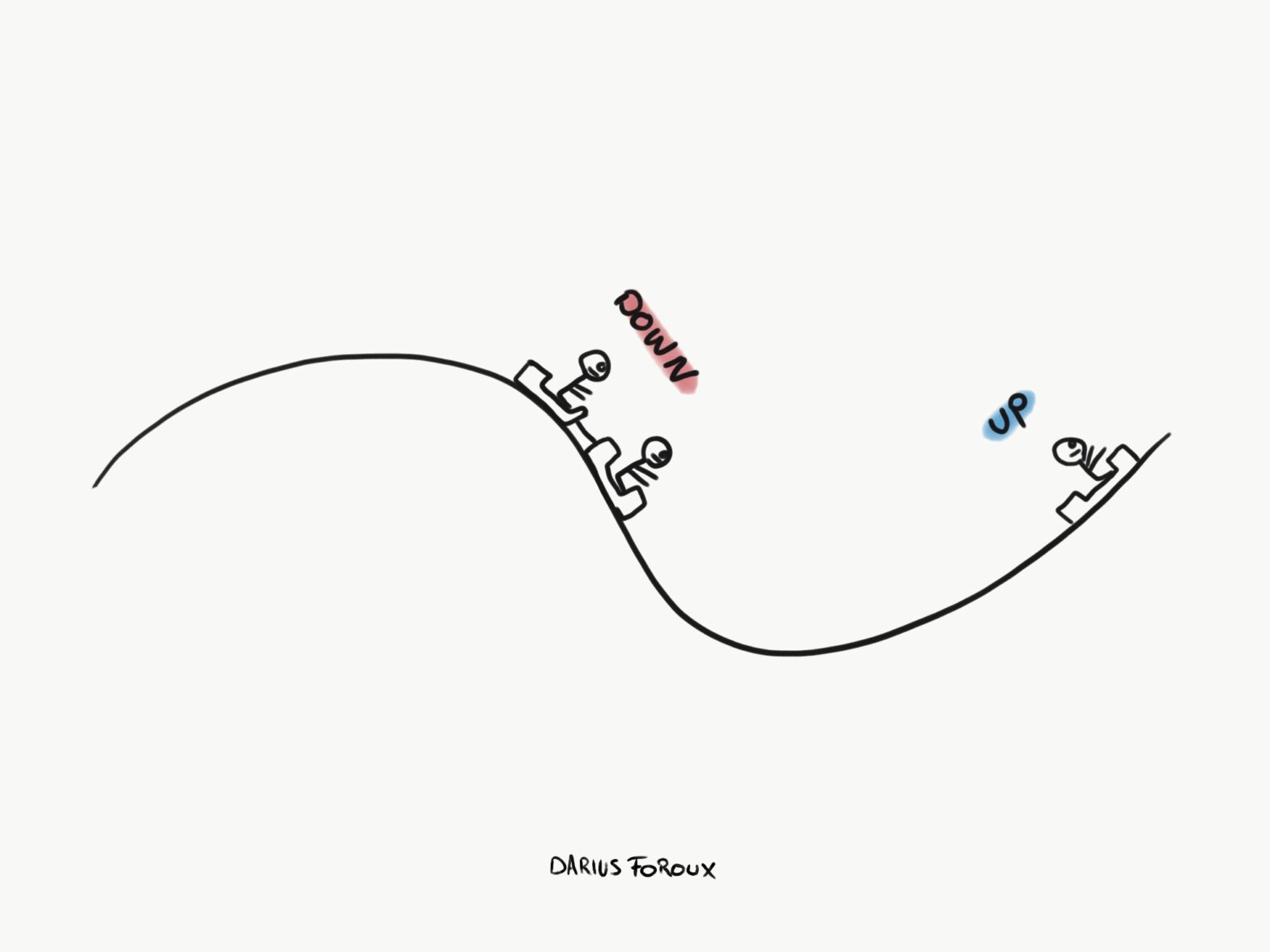

Analyzing the crypto market’s cyclical nature reveals striking similarities between the current and past cycles. Although precise timing may vary, the pattern of cyclical trends is evident, as shown in the Ethereum chart included below from a previous cycle.

2020 Overview:

– At the beginning of the 2020 Bitcoin cycle, Ethereum experienced a significant surge. This growth was halted by the global lockdowns announced due to the COVID-19 pandemic.

– Post the Bitcoin halving in May 2020, Ethereum saw about three months of sideways trading, characterized by sporadic minor rallies and corrections. These market adjustments aimed to induce time-based capitulation among investors, gradually eroding their resolve to maintain positions.

– By mid-2020, the market embarked on a sustained ascent, peaking during what was popularly referred to as the “Crypto Summer.”

– As the quarter closed in September, many traders locked in profits, leading to a market correction. This was followed by a reaccumulation phase in anticipation of a rally during the election season, which was short-lived, concluding with a sharp correction in November.

2024 Analysis & Projections:

– The final quarter of 2023 saw a bullish trend for Bitcoin, sparked by the anticipation and eventual approval of a spot ETF in early 2024. This approval triggered a market rally that lasted until the end of March 2024, after which a correction occurred due to profit-taking at the quarter’s end.

– Currently, in 2024, the market is undergoing a phase of time-based capitulation, noticeable since the Bitcoin halving in early April. This trend is expected to continue until the end of June, setting the stage for another “Crypto Summer” with potential upward movements until September.

– As September concludes the quarter, profit-securing is likely to prompt another correction across various coins. Investors are projected to reaccumulate assets in anticipation of an election season rally. This period, fueled by the excitement of a new presidential election, is expected to be brief but intense. However, a post-election market correction is anticipated, filtering out investors driven by mere speculation.